History of Customs in Honduras and the World

The Customs System in Honduras is part of the structure of the Ministry of Finance under the name of Executive Revenue Directorate, created in November 1994. This directorate was born from the merger of what was the General Customs Directorate and the General Taxation Directorate and assumed its functions and powers as such starting from February 1995.

What can now be considered the country’s Customs service, now called the Revenue Administration Service (SAR), is the result of a long evolutionary process inspired by the need to make tax collection services in the country more efficient, effective, and transparent. See Customs of Honduras

Background

Its earliest predecessor can be found in what was called the General Revenue Directorate, which later became the General Customs and Indirect Taxation Directorate, and it was not until July 1, 1956, that it was created by Decree Law No. 254 as the General Customs Directorate, depending on the Ministry of Finance and Public Credit.

As the General Revenue Directorate, it was responsible for the control of imports and exports, fiscal species, and especially the control of the production and commercialization volumes of the liquor industry, which constituted a state monopoly. In this stage, Revenue Collection Offices appeared with offices in different departmental headquarters and in the main cities of the country.

General Customs and Internal Revenue Directorate

In late 1957, the General Revenue Directorate changed its name and gave way to the emergence of the General Customs and Internal Revenue Directorate, operating with an organizational structure that incorporated departments and sections such as the General Secretariat, Administrative Section, Import and Export Policy Review, Customs Warehouses, Fiscal Species, and Alcohols and Liquors.

During this time, the state suffered losses of several million lempiras, especially in fiscal species, due to a voracious fire that destroyed almost all the facilities and archives of what was the General Customs Directorate.

After this fire, the General Customs Audit was created, entrusted with the review of policies, formulation of adjustments, and resolution of cases that were brought up in appeals before the General Customs Directorate.

The General Customs Directorate was the department responsible for the registration and control of imports and exports of goods, national alcohols, and liquors.

In 1971, the Fiscal Investigation Department was formed, tasked with countering smuggling and tax fraud, which had reached highly increasing levels in the country at that time, mainly due to the lack of efficient controls and the rising corruption that emerged as a danger to the national tax system.

In 1975, the General Customs Directorate was restructured, creating the Customs Valuation Department, responsible for the implementation of the Customs Valuation Law, which established the basis for assigning real values to goods and preventing undervaluation during the introduction of goods, primarily from imports.

During the period from 1982 to 1989, other departments were created due to the expansion of activities, functions, and the need for increased control measures. It was during this time that the Claims, Enforcement, and Technical Advisory departments emerged.

This has allowed for necessary adjustments to the real values of goods and tax rates, while also providing a greater opportunity for those affected to file claims in accordance with legal procedures and receive the necessary technical advice to avoid potential disputes among the parties involved.

Currently, starting from March 1990, a new organizational restructuring was carried out, aiming at the centralization of related functions, with clearly defined vertical guidelines.

Creation of the Executive Revenue Directorate

By implementing the new structure as outlined in its project, highly positive results would be achieved. However, considering that the structures of the General Customs and Taxation Directorates, both under the Ministry of Finance and Public Credit, did not respond to the technological advancements in revenue collection that exist in modern administration, it was thought that the only way to improve the behavior of officials and employees in these departments, eradicate corruption, and enhance tax revenues was through the professionalization and technical organization of a revenue office.

Therefore, in 1994, the National Congress of the Republic, through Decree No. 159-94 dated November 4, 1994, enacted the law creating the Executive Revenue Directorate (DEI) as a decentralized body under the Ministry of Finance.

The Executive Revenue Directorate is the institution responsible for the administration of all tax revenues, including customs revenues. It acts on behalf of the State in fulfilling the functions of revenue collection, supervision, review, control, auditing, and enforcement of tax laws. Without prejudice to the organizational structure of the Ministry of Finance, the Executive Revenue Directorate has its own organization, including a special system of nomenclature, classification, and remuneration of positions, as well as its own regulations for personnel, disciplinary matters, administrative contracting, and tax and customs career to ensure the fulfillment of its functions.

The annual budget of the Executive Revenue Directorate is included in the budget of the Ministry of Finance and is set as a percentage of the tax revenues it administers and collects in the immediately preceding year, not exceeding two and a half percent (2.5%) of the same. The resources are credited in advance on a monthly basis and deposited into special accounts at the Central Bank of Honduras.

On February 1, 1995, the Executive Revenue Directorate assumed all the functions and powers of the former General Customs Directorate and General Taxation Directorate.

In the case of the Tax Police and in order to facilitate an orderly transition, the functions were gradually assumed in accordance with the deadlines and other aspects provided for in the regulations of the Law creating the Executive Revenue Directorate.

With the creation of Decree No. 216/2004 dated December 29, 2004, Decree No. 159-94 dated November 4, 1994, containing the Law of the Executive Revenue Directorate (DEI), as well as its amendments contained in Decree 142-2004 dated September 30, 2004, and any other provisions contrary to this Law, are repealed.

This Decree establishes the Law on the Structure of the Tax Administration of the Executive Revenue Directorate (DEI) as an administrative body directly dependent on the Ministry of Finance, with its headquarters in the capital city and authority throughout the national territory.

As part of the process of modernization, restructuring, and administrative simplification of the tax administration, the Regulation on the Organization and Functions of the Executive Revenue Directorate was approved by Agreement No. 0397-2005 dated May 4, 2005.

Since its creation, the Executive Revenue Directorate has played a very important role in the country, particularly in its major objectives of eradicating corruption, tax evasion, undervaluation of goods, and the modernization of revenue collection services, as well as advancements in tax and customs legislation.

This is one of the government agencies in which the entire population has placed many hopes, especially because through efficient and honest tax collection, it can increase the state’s income and utilize it to provide quality education, healthcare, improve infrastructure, and create employment opportunities, thereby expanding the purchasing power for the satisfaction of material and spiritual needs of the community.

Vision

To be an efficient and transparent institution capable of leading the transformation of the country’s foreign trade, with qualified and committed human resources, and adequate technological means for modern and competitive customs management.

Mission

To guarantee trade facilitation, revenue collection, and security through efficient control, using best practices to contribute to the growth and dynamism of the country’s economy.

Strategic Objectives

- To increase customs tax revenue through the provision of agile and timely services, contributing to the economic and social development of Honduras.

- To increase voluntary compliance with customs obligations in order to reduce tax fraud.

The Customs Service Over Time

According to the dictionary of the Royal Spanish Academy, in its nineteenth edition, the term «Aduana» derives from the Arabic word «ad-divoana,» which means «the registry.» Some claim that it originates from the Italian «duxana» because in Venice, goods paid an entry tax that belonged to the «Doge.» Others believe it derives from «douana» or «dovana,» which means «duty.»

However, regardless of its etymological meaning, «aduana» is used to designate government agencies that are involved in the international traffic of goods being imported or exported and are responsible for collecting the taxes imposed on them. It should be noted that customs also intervene in coastal trade, even though there is no international traffic in this operation. However, it is also the function of customs to ensure that the goods transported in coastal trade to another national port are the same as those that were loaded.

Regardless of the economic implications of International Trade, it can be said that its intensification and regulation are the precursors of customs services, considered either as a means of increasing fiscal revenue through import and export taxes or as a tool to implement any protectionist economic measure adopted.

Primitive Organizations

In Primitive Social Organizations, taxes (direct) are already found in the form of personal service, such as military service, as well as in the form of real service (a portion of the booty that is allocated to the tribal chief). Subsequently, tribute payments in kind appear, such as capitation, and tributes on the yields of agriculture and livestock (tithes). Much later, when the needs of the State grew, taxes took on an indirect form. Among other indirect taxes, customs duties seem to have been known in India, as well as in Persia and Egypt. In Greece, they existed alongside capitation taxes (on foreigners) and consumption taxes on sales.

Customs in Ancient Rome

In Rome, customs duties seem to have been established by Anco Marcio on the occasion of the conquest of the Port of Ostia. It is said that because it was a port where the tax was first established, it was called «portorium,» although this term included other taxes, such as tolls.

At the beginning of the imperial era, the portorium was leased through public auction for periods of five years at a fixed rate. Later, the system was changed, and the collection was entrusted to one or several imperial officials who had to account for their actions and received a percentage of the sums that entered the Treasury. Finally, the system of direct collection by the State was established.

The customs duty in Rome applied to both imports and exports, as a result of the purely revenue-oriented or fiscal nature that the tax had at that time. With few exceptions, this remained valid until the 17th century, during which the large modern states were established, and the first economic doctrines of nationalist policies appeared.

Middle Ages

In the Middle Ages, personal taxes (direct taxes) were reintroduced, as there was no Public Treasury or true taxes in the beginning. Feudal lords imposed capitation taxes and territorial taxes on their vassals and collected certain fees for the movement of people and goods (tolls, portage, pontage, boat fees), as well as taxes on property transfers and successions. The king relied on his own assets and the right to demand contributions for his needs, but there were no principles, bases, or tax systems.

We have to jump to the Italian Republics of the 12th and 13th centuries to find true general taxes: some direct taxes, such as those on capital or wealth, and others indirect, such as customs duties. The latter began to spread along with the development of commerce, particularly maritime trade, during that time.

We also find customs duties in England, where, according to McCulloch (a 19th-century English economist and disciple of Ricardo), they were established even before the Italian Republics. However, while the Italian Republics, especially Venice, imposed customs duties with restrictive measures to protect their industry and trade, England established them purely for financial purposes, a policy that was somewhat modified until the 17th century.

Modern and Contemporary Period

Until the 17th century, customs duties, both external and internal, generally had a purely fiscal or revenue-oriented character. The protectionist idea, which emerged shortly after the establishment of large modern states as a means to increase the wealth and power of a country, can be seen in the principles that inspired the policies of Cromwell in England and Colbert in France, aiming to ensure the development of national industry by protecting it from foreign competition.

From Colbert’s industrial protectionism, albeit imperfectly, the modern customs systems emerged, driven by a specific economic idea. The suspensive regimes of customs duties became highly significant and have evolved to their current form today.

This highlights the increased intervention of the state, undoubtedly following the general evolutionary trend that seeks to limit the realm of the individual in favor of the collective. The growth of this intervention has been achieved through various forms of customs taxation and has reached its present-day application through bilateral or multilateral free trade agreements.

Related

- Customs of Honduras

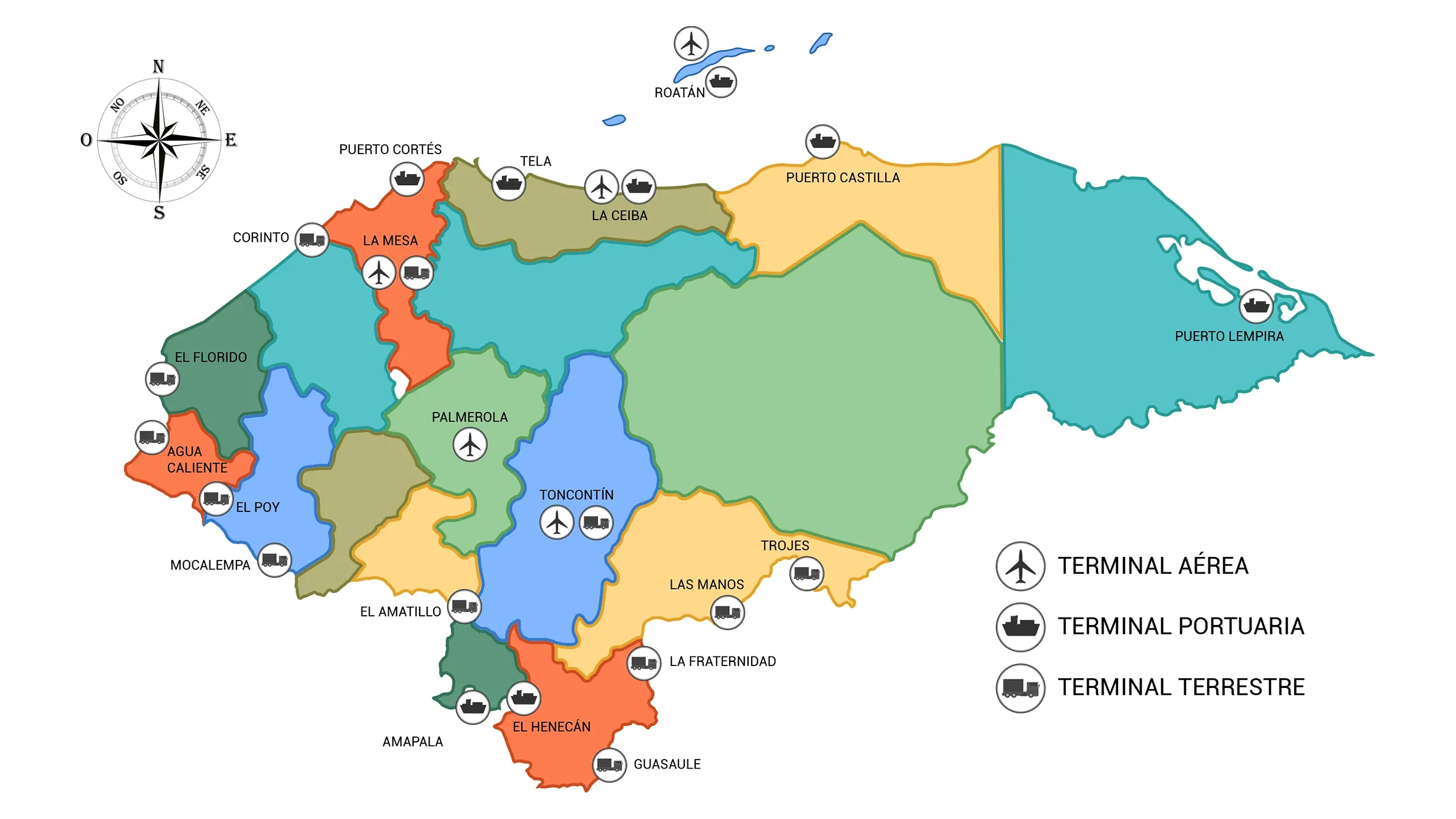

- Map of Customs in Honduras

- Obligations and Benefits of Traveling to Honduras

- Customs Union between Honduras and Guatemala

- Honduras Customs Administration